The Next Phase of AI Enablement Has Already Begun:

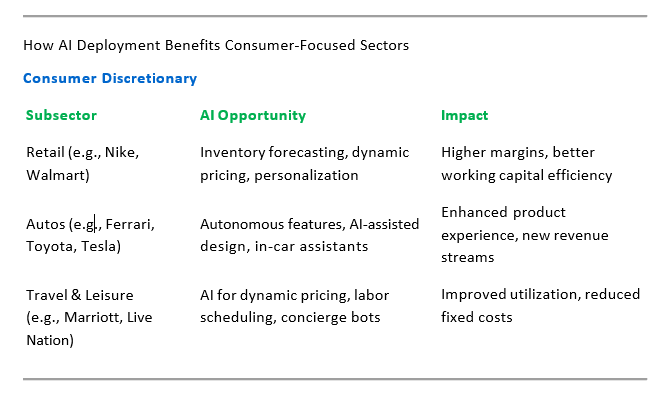

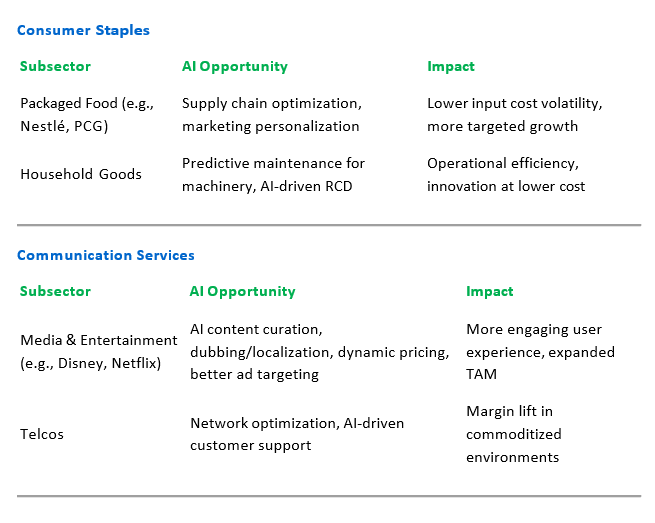

As investors pile into technology stocks amid the AI revolution, a critical inflection point is emerging — the shift from AI infrastructure buildout to mass enterprise deployment. While semiconductor and hyperscaler names have dominated early returns, the next and potentially more durable phase of value creation will come from AI’s application across traditional industries & sectors. Remember, it’s the companies with the most robust data that will likely receive the disproportionate benefits from AI deployment. Consumer companies have massive amounts of data on their customers and this data + AI inferences can drive incredible benefits to customers and leading brands. For investors like us — focused on global household consumption and the enduring strength of brand-driven businesses — this shift represents a compelling opportunity. As AI tools move beyond labs and data centers into real-world operations, many companies historically seen as lower-growth or having structurally lower-multiples stand to benefit from a wave of productivity, profitability, and ultimately, multiple expansion.

Consider this:

There’s about $3 trillion invested in technology-focused ETF’s alone. Most core and growth indexes have technology as the highest weighted sector as well. Whether they realize it or not, investors have an enormous overweight position to technology. Thank heavens many of the leading tech brands are highly profitable and quality businesses but the reality is, a typical portfolio is wildly underweight many other sectors and opportunities. Imagine if just a fraction of the trillions invested in technology shares decided to invest in other sectors that are sure to benefit from AI deployment. The Consumer Discretionary & Staples sectors combined have less than $100B in assets. When the evidence of these benefits arrives to non-tech companies, there’s a very large wave of capital coming to a much smaller shore, which is sure to have a disproportionate effect on the companies that innovate the most.

Let’s analyze the 30,000-foot view on AI and where we are today.

We see two phases of the AI revolution thus far:

1. The Buildout Phase: started in 2019

This phase was characterized by:

• Explosive demand for AI infrastructure: GPUs, accelerators, custom silicon.

• Capex surges by hyperscalers to build AI-ready data centers.

• Strong returns for chipmakers (e.g., NVIDIA, Broadcom), cloud platforms, and power/utility providers.

2. The Deployment Phase: started 2024

This phase will be marked by:

• Mass enterprise integration of AI tools into workflows.

• A sharp rise in productivity, cost savings, and customer personalization.

• Margin expansion and renewed earnings growth across non-tech sectors.

• Early development & deployment of AI agents (Agentics).

• Capital shifting from tech-heavy names to the broader economy making “the rest of the market” a more intriguing investment than it’s been in many years.

Why This Matters to Global Brands Investors

We have long prioritized companies with:

• Durable demand factors tied to global household consumption.

• High brand relevance and global pricing power.

• Sustainable economic moats, stronger balance sheets, & global opportunities.

Many dominant brands trade with lower average multiples when compared to most technology stocks. That dynamic is about to change for brands with vision, capex to deploy, and an eye for AI efficiencies

The Hidden Alpha: Multiple Expansion in Lower-Multiple Sectors

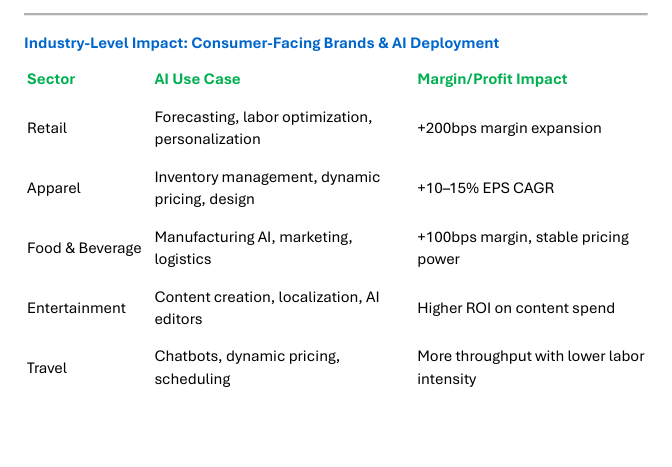

With AI improving operating leverage and compressing cost structures, industry leaders outside the technology sector are poised to:

• Deliver faster earnings growth.

• Unlock operating leverage while generally keeping headcount flat.

• Improve FCF yields with higher ROIC.

• Improve margins & profitability meaningfully.

As AI-powered companies show similar growth rates & never-before-seen operating leverage, but from a lower base — the re-rating potential is meaningful. For now, very few investors are focused on this inevitability. That makes our team excited to be early to this party.

Capital Flows Are Poised to Shift

The setup:

• Technology has become over-owned and increasingly crowded with >$3 trillion in ETF AUM alone. Plus, tech is >35-50% in many growth & core indices.

• AI tailwinds will begin flowing into other sectors.

• Active managers are looking for laggard plays on AI with better valuation upside.

This creates a window where capital will rotate into quality brands and consumer-facing names that show tangible AI deployment benefits. We already see tangible signs of AI benefits in brands like: Walmart, Amazon, Mercado Libre, Spotify, Netflix, Uber, Microsoft, Tesla, American Express, Blackstone, Apollo, KKR, Booking Holdings, Service Now, Coca Cola, Goldman Sachs, CBRE, Draftkings, Shopify, Intuit, Caterpillar, Robinhood, with much more to come.

Brand Case Studies: AI Driving Profits and Re-Rating

1. Walmart (P/E ~24x)

AI Deployment:

· Real-time inventory management with generative AI forecasting.

· Automated supplier negotiations using AI bots.

· Labor scheduling optimization in warehouses and stores.

· Higher customer engagement C cross-selling opportunities.

Result:

· Improved inventory turns, lower shrinkage, and optimized labor costs.

· Potential margin expansion of 150–200bps over 3 years.

· As EPS grows faster than the long-term average and the multiple re-rates higher due to better profitability, stock price could appreciate 50%+ from current levels.

· At the current $700B in annual revenues, we expect Walmart to join the $1 trillion club on its current trajectory. Implementing more AI tool could accelerate this trip.

2. Amazon Retail

AI Deployment Areas:

1. Personalization & Recommendations

o AI refines product search, cross-selling, and bundle suggestions based on user behavior.

o Improves conversion rates and increases average order value (AOV).

2. Dynamic Pricing & Promotions

o Algorithmic pricing adjusts in real-time to competitor prices, supply chain constraints, and customer behavior.

o Enhances margins without losing market share.

3. Logistics & Inventory Optimization

o Machine learning predicts demand and optimizes warehouse placement and delivery routes.

o Reduces shipping costs and improves delivery speed.

4. Customer Support Automation

o AI chatbots reduce reliance on human reps while increasing resolution speed.

o Lower SGCA costs and improved customer satisfaction.

5. Robotics & Fulfillment Automation

o Expanding use of warehouse robotics and AI-assisted sorting reduces labor intensity per package.

o Lowers cost per unit and supports scale without headcount growth.

Amazon Web Services (AWS):

AI Deployment Opportunities:

1. Foundational Infrastructure

o AWS provides compute and storage for model training and inference.

o Leader in custom silicon (e.g., Trainium, Inferentia) tailored to AI workloads.

2. AI-as-a-Service (AaaS)

o Sagemaker, Bedrock, and Q democratize access to LLMs and fine-tuning.

o Broadens AWS's customer base to include SMBs, enterprises, and developers who can't build in-house.

3. Verticalized AI Tools

o AWS provides tailored solutions to healthcare, fintech, retail — creating industry-specific moat

o Enhances stickiness and increases “per-customer spend”.

4. Global Hyperscaler Share Gain

o As AI drives global capex, hyperscaler spend accelerates — AWS captures significant share via compute contracts and data migration.

Result:

· Amazon Retail operating margins continue to expand as cost to serve falls.

· EPS accelerates to high teens over 5 years.

· AWS revenue re-accelerates from mid-teens to 20%+ CAGR.

· Margins remain high and expand further, even with high cap-ex commitments.

· Overall, margins expand, operating leverage improves, headcount stays contained, profitability balloons, stock has meaningful re-rating higher.

1. Netflix

AI Deployment Areas:

1. Personalized Content Discovery

o AI refines the recommendation engine with LLM-enhanced user profiles, mood detection, and context-aware suggestions.

o Results in longer watch times, reduced churn, and better content ROI.

2. Localized Content Creation

o AI dubbing, voice cloning, and real-time subtitle generation allow global releases at scale.

o Lowers cost of localization while increasing international appeal and velocity of new releases.

3. Script & Production Optimization

o AI-assisted tools identify story arcs, sentiment analysis, pacing, and character modeling.

o Enhances hit rate of originals and trims development cycles and production waste.

4. Dynamic Ad Targeting (Netflix’s Ad Tier)

o AI tailors’ ads by viewer behavior, geography, device, and content type.

o Yields better monetization per user.

5. Churn Prediction & Pricing Optimization

o Machine learning predicts the likelihood of churn and adjusts retention offers or suggests pricing tier adjustments.

o Improves net subscriber retention and average revenue per user (ARPU).

Conclusion: AI adoption is a 1st inning opportunity for investors.

For now, all investors seem to want is technology stocks. Keep your eye on the prize: We believe the next AI leaders will not just be those building the tools — but those using them to transform their businesses. This spans industries and the most innovative companies could see meaningful re-ratings as the benefits show up in earnings results.

The opportunity ahead for global brand investors is to identify:

· Trusted consumer franchises.

· With the will and ability to deploy AI at scale.

· In ways that improve margin structure, ROIC, and brand equity.

The AI revolution may have started in Silicon Valley. But its longest-lasting impacts will be felt in the aisles, screens, homes, and experiences that define global consumption.

Carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. This and other information can be found in the Fund’s statutory and summary prospectuses, which may be obtained at LogoETF.com. Read the prospectus carefully before investing. Equity Market Risk. By virtue of the Fund’s investments in equity securities, the Fund is exposed to common stocks which subjects The Fund to equity market risk. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from specific issuers. Equity Securities may experience sudden, unpredictable drops in value or long periods of decline in value. Foreign Securities Risk. Investments in securities or other instruments of non-U.S. issuers involve certain risks not involved in domestic investments and may experience more rapid and extreme changes in value than investments in securities of U.S. companies. Financial markets in foreign countries often are not as developed, efficient, or liquid as financial markets in the United States, and therefore, the prices of non-U.S. securities and instruments can be more volatile. Economic and Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. Securities in the Fund’s portfolio may underperform in comparison to securities in the general financial markets, a particular financial market, or other asset classes, due to a number of factors, including inflation (or expectations for inflation), deflation (or expectations for deflation), interest rates, global demand for particular products or resources, market instability, financial system instability, debt crises and downgrades, embargoes, tariffs, sanctions and other trade barriers, regulatory events, other governmental trade or market control programs and related geopolitical events. Models and Data Risk. The Sub-Adviser’s evaluation of potential Fund portfolio holdings is heavily dependent on proprietary quantitative models as well as information and data supplied by third parties (Models and Data). When Models and Data prove to be incorrect or incomplete, any decisions made in reliance thereon may lead to the inclusion or exclusion of securities from the Fund’s portfolio that would have been excluded or included had the Models and Data been correct and complete. New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions. Investing involves risk, including possible loss of principal. Distributed by Foreside Fund Services, LLC