Excerpts from KKR’s Mid-Year 2023 Outlook Deck “Still Keeping it Simple”

Key Points from the perch of a consumer trends & global brands investor.

KKR Mid-Year Outlook: Summary

I’ve always believed watching what the smartest investors in the world are doing, offers the average HNW investor a wonderful advantage. The largest alternative asset managers, including the private equity and private credit firms, have an information advantage over the typical individual investor. Firms like Blackstone, KKR, and Apollo, collectively own over 500 companies around the globe. These companies employ millions of workers across virtually every sector. Having “boots on the ground” information helps these firms see around corners better than the rest of us. This advantage has historically translated into superior returns across the private investment funds they manage. That’s why we own the stocks of these great brands. Currently, all 3 stocks are on sale and offer attractive entries while paying dividends that will grow over time. Today, I want to deviate from the normal consumer trends note and summarize KKR’s newly released 2023 Mid-Year Outlook because it’s important for advisors to consider these ideas as they allocate. The full report is long, so I thought a summary would be helpful for those short on time.

Summary:

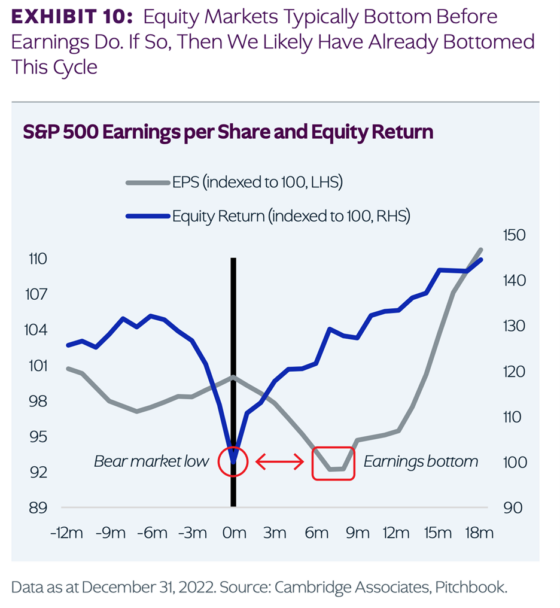

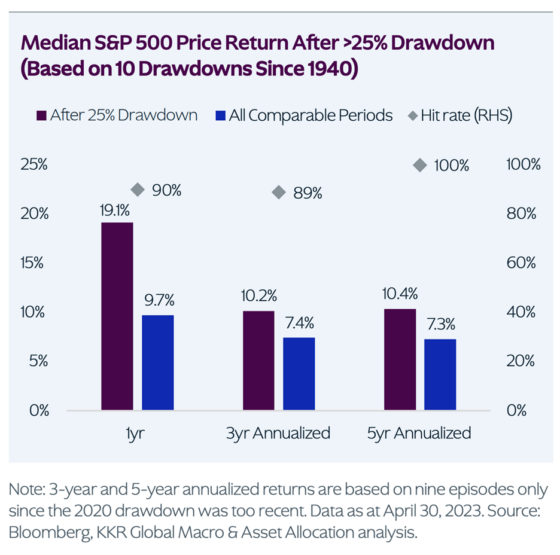

We think that the bottom is in for the S&P 500 this cycle, and that it occurred October 2022.

Similarly, within Credit, our view is that prices are likely to stabilize in the current $85-90 range, and while we expect an increase in defaults, we think the longer-term path is upwards from current levels.

Our proprietary framework suggests that cyclical leading indicators, on a net basis, are in a mild contractionary phase in the U.S.

Importantly, we do not expect the same type of economic downside as in past cycles, especially on a nominal basis.

After multiple trips across Asia, Europe, and the United States to pressure test our macro frameworks in the first-half of the year, we think investors are still too conservatively positioned for the path forward we are seeing for the global economy.

We actually remain constructive on risk assets, given stronger nominal GDP growth than in past cycles.

Rarely has there been such an intersection of poor near-term fundamentals, more than offset, we believe, by a compelling technical backdrop (i.e., little new issuance supply, record buybacks) and resounding negative sentiment (S&P 500 shorts are near 30-year highs); at the same time, recent dislocations have created some stand-out investment opportunities that traditional 60/40 investors might be overlooking.

We continue to believe in our ‘higher resting heart rate’ thesis as the crucial disinflationary forces of the last ten years (globalization, lower energy prices, and a labor surplus) have all largely reversed course.

Near term crosscurrents notwithstanding, we remain constructive on the structural outlook for energy and energy-related investments going forward. We think impressive capital discipline by U.S. producers could support durable long-term pricing that averages closer to $80 per barrel, up from the pre-pandemic range of $50-60 per barrel.

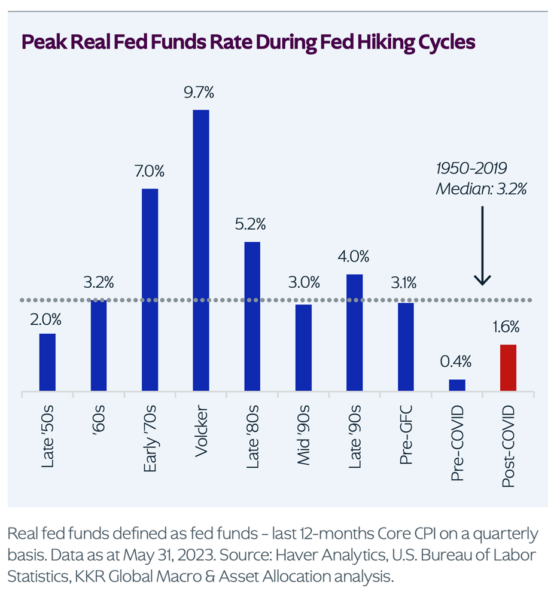

We still think that markets are not fully pricing the uncertainty around the pace of Fed cuts, which is why we still have 10-year Treasury yields ending the year at four percent.

Though we are more conservative on growth in the developed markets in coming years, we think the biggest surprise this cycle may be that growth does not slow as soon, or as disastrously, in aggregate as the consensus now expects.

One third of small banks’ assets are CRE loans. Deposit flight is also still an issue. As such, we think that more regional banks could come under pressure if we are right that the Fed does not cut rates in the near term.

We feel better that we will avoid a major drawdown this year.

We have now entered a new regime of higher nominal growth and structurally higher interest rates, which we believe suggests that investors cannot go back to what ‘worked’ over the last ten years.

The most important takeaway for investors right now may be that, on a global basis, consumers are actually in better shape than many appreciate amidst improving wage gains, elevated household savings, and meaningful fiscal tailwinds.

This is the new macro regime we believe investors must focus on when building portfolios.

Important: Not every company wins in this type of regime. Pricing power, competitive moats, margin stability, cash flow generators, and lower debt companies should be emphasized.

Compelling portfolio opportunities:

Given the ongoing banking crisis, most forms of both Liquid and Private Credit screen well in our forward expected returns analysis. Importantly, the recent turmoil in the U.S. banking system has only reinforced our view that corporations will need to seek alternative forms of lending to fuel growth, make acquisitions, and repay existing loans.

The last 5 years, Private Credit on average returns were ~6.5% net of fee/carry. Over the next 5 years, we expect this asset class to have estimated returns of ~8.3% net of fee/carry.

The last 5 years, Private Equity on average returns were ~15.6% net of fee/carry. Over the next 5 years, we expect this asset class to have estimated returns of ~11.9% net of fee/carry. This is versus an expected S&P 500 return of roughly 5.3% (9.4% last 5 years).

The last 5 years, the Global Agg Index on average returns were ~-1.7%%. Over the next 5 years, we expect this asset class to have estimated returns of ~4.4%.

We also think that today Cash is an interesting asset class.

Equities with growing dividends.

We reaffirm our call for stronger small-cap performance. U.S. small-cap stocks are trading at the biggest discount to large-cap stocks in over 20 years.

Foreign stocks are starting to look more interesting. We continue to see better value in Japanese, European, and even Mexican stocks, all of which are trading at relatively undemanding valuations and stand to benefit if we are right about a structurally weaker U.S. dollar.

Real assets look attractive in an era of higher inflation.

Given that U.S. real goods buying is still running six percent above trend, we continue to support flipping exposures towards services, which we now think could run ahead of trend for several years. Sectors such as tourism, health and beauty services, and entertainment still have a long way to go internationally, we believe.

We expect excess savings and a strong labor market to keep consumer spending above trend.

Asia is still in the process of post-COVID reopening, especially China, which often accounts for 20% or more of global growth. Against this backdrop, we continue to see an asynchronous cycle, with China’s reopening and recovery propelling regional growth higher. Connecting the dots: companies (brands) serving Asian consumers should perform well.

China consumers are still sitting on over six trillion RMB in ‘excess’ savings, equivalent to fully 15% of annual retail sales.

China Retail Sales are still 15% below its pre-COVID trend.

Spending on Generative AI looks set to explode in the coming years

Bottom line:

Unless the bull case unfolds, we expect a bumpy, volatile ride ahead, which would present investors with opportunities to lean into dislocations. Aka, build portfolios with the above themes in mind, hold some cash that earns 5% to be able to build bigger positions in these themes when dislocations occur. Our expectations for low but rising real rates point to more muted upside for multiples going forward. We are simply moving back to a more normal “base rate” and overall interest rate environment. That’s a healthy development but the road to normal could be bumpy on occasion. Use these periods to be an opportunist. Emphasis on ours.

Historically, following large drawdowns, longer-term investors are generally rewarded over the next 3-5 years for leaning into dislocations.

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.