Country Ranking Model - May 2023

Source: MSCI

There was little change at the top of our rankings this month. Western Europe continues to be well represented in our model, as does Latin America with Chile, Brazil and Mexico all overweight. Interestingly, the world’s two largest economies, China and the U.S., screen poorly from a multi-factor perspective and rank towards the bottom of the table.

Concerns over delisting, regulatory crackdowns and geo-politics are clouding the investment case for Chinese stocks. China ranks last in terms of political risk in our universe and was the worst performer on the month, down -5.16%. Nevertheless, Chinese fundamentals at both the company and macro level are compelling. Indeed, in contrast to Western economies that are flirting with recession, the Chinese economy registered Real GDP growth of 4.5% YoY in Q1 2023.

Similarly, the U.S. shows strong fundamentals relative to other countries in our universe. However, it has very expensive valuations. Furthermore, risk has increased, as evidenced by a widening of CDS spreads in the face of a potential failure to lift the debt ceiling.

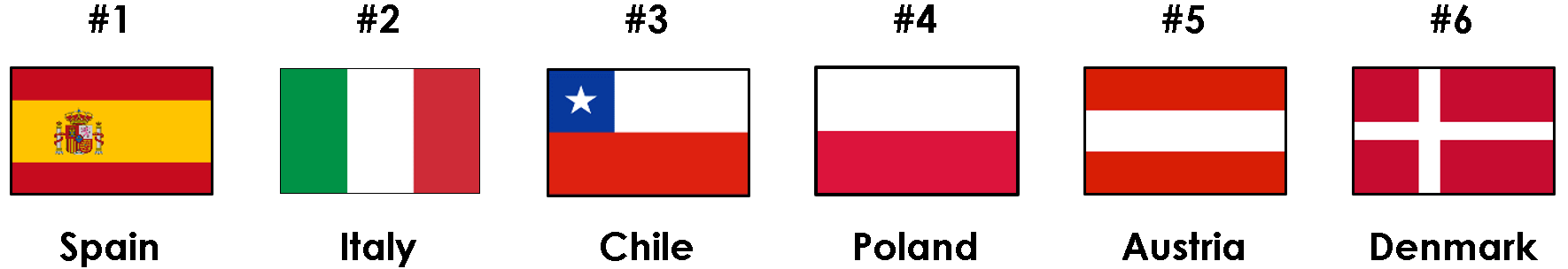

May Country Rankings

Spain (#1): Spain has moved into first place this month. Spain ranks well across the board, but is particularly strong in terms of momentum (ranked 3rd) and valuations (ranked 9th). The country is expected to avoid a recession in the near term, and forecasts suggest that growth, albeit subdued, is likely to be higher than in other Eurozone economies in 2023.

Italy (#2): Italy, like Spain, is strong from a momentum and valuation perspective (ranked 4th and 5th respectively). The Italian economy has been resilient amid the global slowdown and economic forecasts are encouraging. For example, the IMF projects that Italy’s 2023 annual inflation rate will come in at 4.5%, which is significantly lower than the forecast for the Eurozone at 5.3%. Stocks such as Unicredit, Moncler and Ferrari have helped Italy outperform the global index this year.

Chile (#3): Chile has number one-ranked valuations, excellent fundamentals (ranked 4th), strong momentum (ranked 8th) but very high risk (ranked 30th). Chile underperformed on the month as it was dragged down by the Materials sector, with SQM (the Chilean chemical giant) posting negative returns in the face of falling lithium prices.

Country Performance:

Data as of 4.28.2023

Source: MSCI

Country Ranking Model

As of 4.28.2023

Disclosures: This information was produced by and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved and may be significantly different than that shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.