Market Outlook: Stay Defensive

At the heart of our cautious Q4 outlook is our belief that the Federal Reserve will hold interest rates “higher for longer” – i.e., keep rates at restrictive levels for longer than the market is anticipating. We think the Fed will do this because the economy has been remarkably resilient. The consumer has yet to pull back on spending and the labor market remains extraordinarily tight - which is putting upward pressure on inflation. The Consumer Price Index (CPI) remains at an uncomfortably high rate of 3.7%, well above the Fed’s 2% target. Therefore, we believe the Fed will remain steadfast in its fight against inflation and will continue to target slower growth and a cooler labor market by keeping rates high.

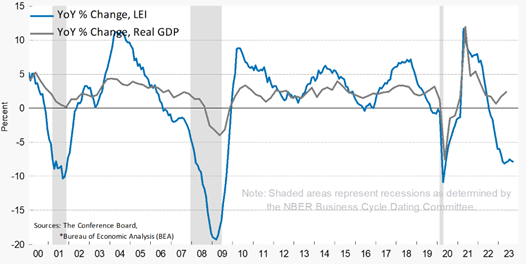

While lagging and coincident economic indicators have been strong in 2023 (e.g., GDP, industrial production, personal income, and inventories) we see concerning leading indicators and signs of weakness ahead. For example, auto loan and credit card delinquencies have now surpassed pre-pandemic levels and indicators such as the leading credit index, consumer expectations for business conditions, ISM manufacturing new orders, and building permits are all in contraction territory. Indeed, the Conference Board’s US Leading Economic Indicators Index last registered -7.6% YoY (exhibit 1).

Exhibit 1

Source: The Conference Board as of 9/30/2023

The consumer has been key to the economy’s resilience this year. But there are signs that spending is slowing. Savings that were accumulated during the pandemic have been drawn down significantly. In fact, for consumers in the bottom income quartile, these savings are exhausted. An imminent pullback in spending can be seen in Morgan Stanley’s consumer health survey, where consumers report that they intend to cut spending in almost all categories. The only areas where spending is expected to increase are in basic consumer staples, namely groceries and household items/supplies (exhibit 2).

Exhibit 2

Source: Morgan Stanley as of 8/30/2023

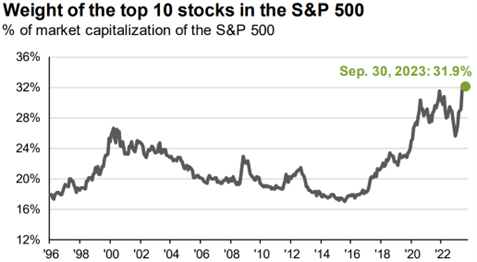

We anticipate headwinds for the consumer and the economy on the horizon as the full impact of the Fed’s tightening cycle is felt. As such, we are concerned that the 12% earnings growth estimates for the S&P 500 in 2024 are too optimistic. With the price/forward earnings ratio for the S&P 500 Index at ~18x and the ten-year treasury yield approaching 5%, we think valuations are too high to support softer earnings growth. We also see elevated downside risk because high valuations are compounded by concentration risk at the index level. The top 10 stocks in the S&P 500 are very expensive at 25.9x earnings (exhibit 3), and they constitute fully 31.9% of the index (exhibit 4).

Exhibit 3

Source: JP Morgan as of 9/30/2023

Exhibit 4

Source: JP Morgan as of 9/30/2023

We think that the equity market has yet to fully reflect the implications of rising real rates, elevated inflation expectations and a shrinking equity risk premium. We think more downside is in store, so we are hedging our portfolios using buffered ETFs. We are similarly cautious in our fixed income portfolios. Q3 was a very difficult quarter for longer-dated bonds, whose term premium continues to adjust to the possibility of higher for longer interest rates. And with the yield curve still inverted, there may well be further downside to bond prices. We plan to hold the core of our fixed income portfolio to maturity and are keeping maturities in the 2024 to 2028 range. We will wait for a clear change in the upward interest rate trend before we extend our bond ladder out beyond 2028.

Positioning and Performance Review

Equities:

Our equity portfolio outperformed the All-Country World Index (ACWI) in Q3 due to our defensive positioning. Approximately half of our equity portfolio is composed of ETFs that have downside protection and an upside cap. We hold US equity buffered ETFs that track the S&P 500 index (tickers: BFEB and BAUG), an International Developed equity buffered ETF that tracks the EAFE index (ticker: IAPR), and an Emerging Market equity buffered ETF that tracks the EEM index (ticker: EAPR). With all of the major equity indexes down on the quarter, these hedged positions significantly helped relative returns. In terms of detractors from performance, US equity markets fared better than international equities in Q3. Therefore, our long-only international equity exposure via Goldman Sach’s multi-factor ETF (ticker: GSIE) detracted from relative returns.

As we move into Q4, we continue to maintain a cautious view on equities and we have recently reduced our equity exposure in our CST models. We trimmed our international equity positions in EAPR and GSIE as international equities are demonstrating relative weakness versus the US. We are now marginally underweight the asset class.

Fixed Income:

Our fixed-income portfolio also significantly outperformed in Q3. Our core fixed income holdings consist of short and intermediate target-term bond ETFs which are exposed to much less interest rate risk than the longer duration benchmark (the Bloomberg US Aggregate Bond Index, commonly referred to as AGG). With interest rates moving higher in Q3, especially at the long end of the yield curve, our shorter-duration portfolio outperformed. Our position in EM Debt via Morgan Stanley’s Emerging Market Sovereign Debt closed-end fund (ticker: EDD) was the only position that detracted from relative returns.

With the proceeds from our equity trims we increased our fixed income exposure by adding to our position in JP Morgan Ultra-Short Income ETF (Ticker: JPST). Fixed income is our preferred asset class in Q4, but we believe that interest rate risk remains high. Therefore, we prefer to keep our maturities in the 2024-2028 range.

Alternatives:

Our satellite position in cryptocurrencies delivered strong positive returns over the quarter and continues to serve as an excellent diversifier in portfolios. Our preferred vehicle for crypto exposure is the Bitwise 10 Crypto fund (ticker: BITW). It provides broad exposure to the asset class as it holds the 10 largest currencies, and importantly, it trades at a significant discount to net asset value (NAV). The benefit of buying funds at a discount to NAV is the opportunity for a narrowing of the discount, which creates a potential source of additional capital appreciation. Q3 provided a good case study in the benefits of this vehicle - despite most crypto coins falling in price over the course of the quarter, BITW’s discount to NAV narrowed, ultimately leading to positive price performance.

We have recently initiated a small position in Managed Futures through the Simplify Managed Futures Strategy ETF (ticker: CTA). Managed Futures strategies have an excellent track record of strong performance and low correlations to equities and fixed income. Simplify Managed Futures Strategy ETF uses a diversified suite of models to generate absolute returns with downside protection.

Disclosures: This information was produced by, and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold, or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets, or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and they may be significantly different than those shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.