A healthy consumer is critical to a healthy economy. In the US, consumption accounts for 68% of the country’s $28 trillion GDP[1]. Globally, consumption accounts for 60% of the world’s $100 trillion GDP[2].

Coming into the year the outlook for the economy was gloomy. There were a host of economic indicators suggesting that an economic slowdown, if not an outright contraction, was imminent. Leading economic indicators were in contraction territory, financial conditions were tightening, new building permits were rolling over, the earnings per share (EPS) growth rate was slowing, CEO confidence was bleak and the 2yr-10yr yield curve was 70 basis points inverted. Most importantly, inflation was running at 6.5% YoY and the Federal Reserve had just raised interest rates by 450 basis points over the course of 9 months (the fastest rate hiking cycle since the early 80’s). All considered, the consensus among economists was a 65% probability of a US recession by the end of 2023[3].

Fast forward to today and these predictions have proven far too pessimistic. In fact, between Q2 and Q3[4] 2023, US GDP grew at a very impressive rate of 5.2% (annualized).

So where is this economic resilience coming from? The answer: the consumer.

How has Consumer Spending Remained Strong?

· Excess Savings

The average consumer emerged from the COVID pandemic with a very strong balance sheet. Monetary and fiscal expansion during the pandemic saw savings rates spike and an enormous stockpile of excess savings accumulated. By JP Morgan’s estimate, excess savings peaked at $2.3 trillion in 2021. Since then, consumers have steadily drawn on these savings, allowing them to maintain spending patterns.

Source: JP Morgan

· Low Mortgage Service Costs

Despite high interest rates on new mortgages, aggregate household debt service costs remain low. In the US, over 90% of homeowners have a fixed-rate mortgage, and more than 40% of all mortgages originated in 2020 and 2021 (when borrowing costs were at historic lows). Therefore, the average rate on the American mortgage is currently ~3.5%, which has effectively immunized many homeowners from the spike in mortgage rates to ~7%.

· Strong Labor Market

Since the pandemic, consumer spending has also been buoyed by the strength of the labor market. And while job openings have come off record highs, they remain very high by historical standards.

Source: US Department of Labor, JP Morgan

The labor market has been able to remain so strong partly because there was a large spike in early retirements and voluntary exiting of the labor force during the pandemic. In fact, labor force participation in the 65+ cohort has yet to return to pre-pandemic levels.

Source: Morgan Stanley

The jobs-workers gap has also yet to be filled due to a significant decline in immigration over the years, a trend that was amplified during the pandemic. In 2021, about 245,000 people from outside of the country migrated to the U.S. – nearly a 50% decline from the previous year, and less than a quarter of the 1 million international migrants in 2016. The foreign-born contribution to the labor force has only recently closed the gap with its pre-pandemic trend.

This tight labor market has given employees bargaining power when it comes to wage negotiations, and it provides workers with greater job security. This has been the primary driver of resilient consumer spending.

Trouble Ahead?

We doubt that the steady decline in excess savings can be counted upon as a regular driver of spending in the future. Indeed, beneath the strong Q3 growth numbers there are some warning signs. For example, the Q3 spending burst came with a decline in the savings rate (from 5.2% in Q2 to 3.8% in Q3[5]), rather than an increase in wage growth. The US personal savings rate as a percentage of disposable income currently stands at 3.8%, well below the long-term average rate of 8.6%[6]. Eventually, consumers should either run out of savings or reduce consumption to rebuild savings. In either case, it will come at the expense of growth in consumption and recent spending patterns.

Additionally, consumers will not be able to remain insulated from higher rates for much longer. Low mortgage payments will not continue indefinitely as new homebuyers enter the market, old mortgages are paid off and homeowners trade-up. In fact, the impact of higher rates can already be seen in non-mortgage consumer credit segments. Auto and credit card delinquencies have now surpassed pre-pandemic levels. Additionally, consumers are bracing for the impact of the return of student loan repayments, which were suspended for several years, and are now required again for most borrowers.

Source: JP Morgan

Arguably the biggest risk to a resilient consumer is a rising unemployment rate. As we look ahead, there are signs of weakening in the labor market, indicating that consumers may be forced to rein in spending. The chart below shows that the jobs-workers gap remains at decades highs. However, this gap has begun to narrow, with Goldman Sachs anticipating further weakening:

Source: Goldman Sachs

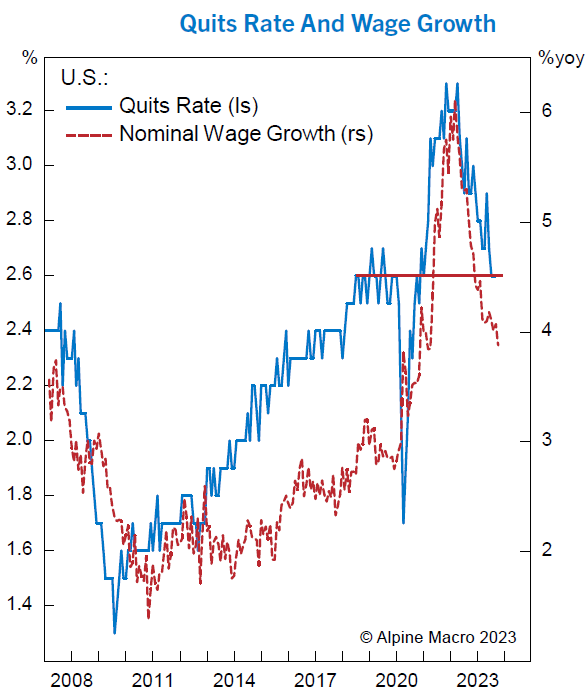

Similar weakness can be seen in the job quits rate, which has slowed and returned to levels similar to 2018/2019. JOLTS layoffs are ticking higher as well. Importantly, the falling quits rate has coincided with falling wage growth, suggesting the labor market is regaining balance.

Source: Alpine Macro

We think the consumer, along with the economy, will face headwinds in 2024. Recent bottom-up consensus revisions to 2024 EPS reflect our concerns. So far this year, 2024 earnings estimates for the Consumer Discretionary sector (-5%) have been worse than revisions for the broader index (-3%) and the Consumer Staples sector (-1%).

Similarly, consumer surveys indicate a strong pullback in spending intentions on discretionary items, towards non-discretionary essentials. Morgan Stanley’s Consumer Pulse Survey released on October 30 revealed that consumers plan to pull back on spending the most over the next six months for home appliances, consumer electronics, food away from home, home improvement, and leisure activities, (discretionary spending) while allocating more towards groceries and home supplies (essentials).

Source: Morgan Stanley

Implications on the Markets

The consensus probability of a recession in 2024 is now 50%, although the probability of a soft landing has risen since the Federal Reserve indicated that its rate hiking cycle is likely over. While investors should never underestimate the consumer’s propensity to spend, we anticipate that excess savings will fall, the unemployment rate will rise, and the full impact of higher interest rates will weigh on confidence. In this investment environment, we maintain a selective and defensive stance in our equity portfolios while tilting allocations towards attractive value in fixed income and alternatives.

[1] Source: Bureau of Economic Analysis

[2] Source: World Bank

[3] Source: Bloomberg US Recession Probability Forecast index, which is median forecasted probability of recession derived from the latest monthly & quarterly surveys conducted by Bloomberg and from forecasts submitted by various banks.

[4] Source: Bureau of Economic Analysis. SAAR as of Q3 2023

[5] Source: Morgan Stanley

[6] Source: Bloomberg

Disclosures: This information was produced by, and the opinions expressed are those of Accuvest as of the date of writing and are subject to change. Any research is based on Accuvest proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however Accuvest does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Accuvest, and do not represent all of the securities purchased, sold, or recommended for client accounts.

The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results. Actual results may vary based on an investor’s investment objectives and portfolio holdings. Investors may need to seek guidance from their legal and/or tax advisor before investing. The information provided may contain projections or other forward-looking statements regarding future events, targets, or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and they may be significantly different than those shown here. The information presented, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.