WE HELP A U.S. AND INTERNATIONAL CLIENT BASE OF INSTITUTIONS, FINANCIAL ADVISORS, AND HIGH NET WORTH INVESTORS IN CAREFULLY NAVIGATING COMPLEX GLOBAL MARKETS. OUR INVESTMENT FOCUS UTILIZES OUR GLOBAL EXPERTISE TO DISTRIBUTE COUNTRY-SPECIFIC ETF INVESTMENT STRATEGIES AS WELL AS A DIFFERENTIATED SUITE OF ICONIC BRANDS PORTFOLIOS (U.S. LARGE-CAP).

Alpha Brands Insights

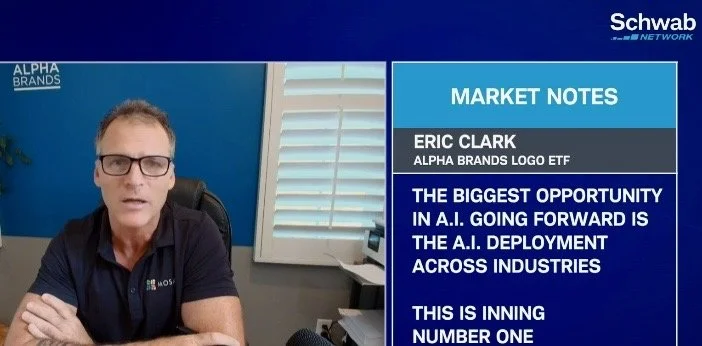

Accuvest CIO Talks Brands on the Schwab TV Network 9/29/2025

Country First Insights

Multi-Asset Class Insights